Most Business Owners Don’t Realize They Can Qualify To

“Get $26,000 Cash for Each W2 Employee

Using the IRS' ERC Program”

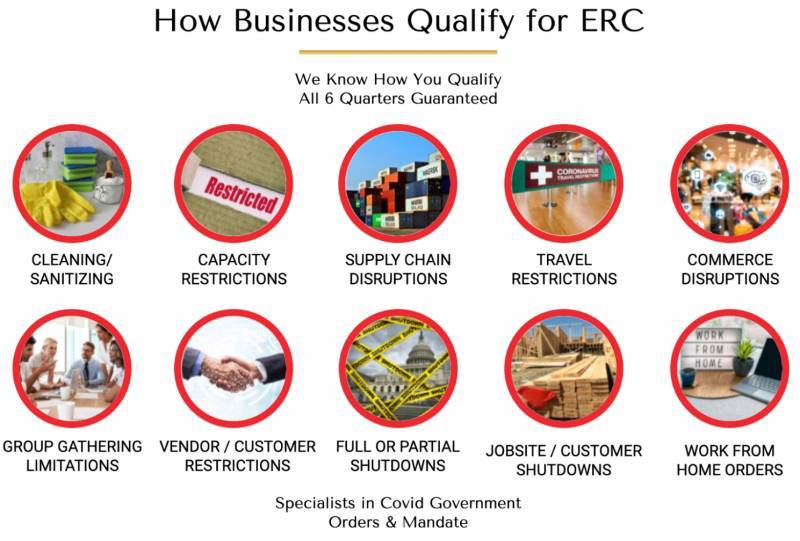

- Qualify 1 of 3 Different Ways (Revenue Reduction, Shutdowns, Supply Chain Disruptions)

- Get Money from the IRS, Even If You Got PPP

- No Cap on Refund. I.e. a 50 Employee Business Can Get $1.3 Million!

- No Up Front Fees. No Credit Check. Not a loan.

Take the 60sec Quiz to Find Out If You Qualify, and How Much You Can Get

Tax Pros

Each account is overseen by a licensed tax professional providing full ERC Audit protection

+$26,000

Payout for each employee with NO cap on max credit received!

$200k

Average credit size per ERC application

“I was skeptical but I liked that [the provider] never asked for any upfront fee. They worked diligently and fast. I felt like I had a true partner the entire time. Words can’t describe how grateful I was when I received a $182,900 ERC check less than 3 months later. Thank you to everyone at Raft Finance for pointing me in the right direction!”

Terry O'Grady, Backyard Games LLC

“ERC seemed too complicated. I didn’t think I’d qualify since I took PPP. But Raft Finance really came through for us. They connected us to a specialist firm that got us over $200,000 in less than 60 days. I used the money to upgrade our facility and now I think we will make it through these next few turbulent years.”

Robert S., CarStar Collisions LLC

Up to $26,000 per W2 Employee Kept on Payroll

Can qualify for multiple quarters in 2020 and 2021, up to $26,000 per W2 employee. Average credit is $200,000+

Can Qualify Even If You Got a PPP Loan

There are many ways to qualify, even if your CPA didn’t think you could qualify. We’re conservative, but qualify you for as much as possible

Reasonable Fee Only After You Receive Credit

We only get paid after you do. Most businesses are getting sent checks by the IRS in 5-9 months

Employee Retention Tax Credit (ERC) Was Put Into Place with CARES Act, But PPP Got All the Attention

The pandemic and related shutdown wreaked havoc on businesses, so Congress passed multiple stimulus acts to distribute relief quickly.

The two programs that got all the media attention were the PPP and EIDL programs. Most didn’t even know about the ERC Program, and even if so, didn’t think they qualified for it (even though it was as good or better than PPP).

Program Was Not Well Understood (even by many CPA’s), so Few Took Advantage

The ERC Program has been amended which can help more businesses qualify.

Unlike PPP, there is no limit on max amount you can receive. ERC is getting more attention as business owners realize they can still take advantage.

Many Businesses Don’t Realize They Can Qualify (for $200k on average), but the Window is Closing

Most businesses don’t realize they actually can qualify, or were told incorrectly by their CPAs that they wouldn’t.

It’s not really the CPA’s fault, as the rules were confusing (and changed multiple times), and this is a very specialized one-time program.

Introducing the 100% Done-For-You ERC Service from Raft Finance

Conservative and Honest Numbers for “Sleep Well at Night” ERC Audit Protection

Our vetted providers work with you during the entire ERC filing process. We make sure all numbers are accurate and fit within ERC regulations.

Our Licensed Professional Partners Do All The Hard Busy Work

We have a dream team of ERC experts who take care of paperwork so you can focus on running your business and simply collect a check.

No Collateral, Personal Guarantee, or Credit Check

Because this is a tax credit from the IRS and not a loan, there is no collateral, personal guarantees, or credit check required to receive the tax credit.

How It Works

1

Take the Qualification Quiz

2

Fill Out Application (Online or Phone)

3

Work With Our Provider to Get Docs

4

Processing, Submission and Payment from IRS

Ready to Get Up to $26,000 per W2 Employee?

The ERC Program is currently open, but has been amended in the past. We recommend you claim yours before anything changes.

Frequently Asked Questions

Qualification

Unfortunately no. This program is only for companies who paid W2 wages to non-owners.

Unfortunately no. This program is only for companies who paid W2 wages to non-owners.

Yes! There are multiple quarters you can qualify for, even if you got a PPP loan. Unfortunately you can’t use the same covered time period that you used for PPP, which might reduce your ERC amount, but you can most definitely qualify for ERC.

Yes! It’s called the “Employee Retention” credit, not the “Revenue Reduction” credit. It’s intended to help out the businesses that kept people employed during the hard times of pandemic, so you can qualify even if your revenue went up. You’ll need to qualify using one of the other qualification checks though – shutdowns / mandates or supply chain disruption.

For most businesses this will be open into 2024 (unless they change the rules again). It’s open as long as you can file amended 941-X returns, which is the later of 3 years from the date you filed your original return, or 2 years from the date you paid the payroll tax.

It doesn’t matter, because this is not a loan – it’s a tax credit. There are no credit checks, collateral, or personal guarantees required.

Yes, there is a possibility. It depends on when the business closed.

Tax Credit

To complete your tax credit, we’ll work with you and your CPA to get the following documents:

- Payroll Journals outlining all payments, deductions, contributions and taxes for each employee for each paycheck during your ERC eligibility period.

- Filed 941, 943 or 944 payroll reports.

- Profit and Loss Statements (P&Ls) for 2020 and 2021

- Tax returns for 2020 and 2021

- PPP Loan Forgiveness Application (if applicable)

Nope! There is nothing to repay with a tax credit. This is not a loan.

We are generally telling clients between 7-9 months. It takes a few weeks to do the work, and the IRS is variable in how long they are taking to process, but we’re seeing in the 7-9 month range.

There is no set amount…

If you owe back taxes on your account, the IRS will deduct the amount you owe in back taxes from the credit amount, and will pay you the difference.

The ERC credit is not actually considered taxable income for federal tax purposes. But what it might do is reduce your company’s deductible wage expenses by the tax credit amount, which will most likely increase your net profit, and therefore what you pay taxes on. Please provide the credit to your CPA or tax preparer for what to do.

Absolutely not! The IRS created this program and doubled-down on making it easier and more lucrative for businesses, so they really want you to file and use it.